Virtual. Loyal. Local.

And data is driving the customer journey

BOB MOWAT

In the second part of Canadian Travel Press’ conversation with Bricklin Dwyer, Mastercard’s chief economist observes that right now, our focus should be on how travel behaviours are pivoting, what consumer demands are evolving and how we can support the needs of all players in travel to map out a new future for the industry.”

Are there new trends developing as a result of COVID-19’s impact on the travel industry? If so, what are they and how might they change the way that the industry deals with its clients?

Despite the travel industry challenges, there are a few trends that have emerged that mirror broader consumer spending – in particular the shift to a smaller radius as consumers travel and spend closer to home:

Bricklin Dwyer

Travel’s Virtual Reality: Virtual Reality tourism has seen a rise as Canadians take to experiencing local and international landmarks from the safety of their own homes. With winter just around the corner, it has even greater potential to pick up pace as consumers choose to “travel” from the comfort of their homes throughout the colder months.

Loyalty Programs Flex: As less people are leaving their social and physical bubbles, travel loyalty programs are increasingly become more flexible. Instead of offering travel rewards and activity booking, we’re now seeing a shift in focus that allows people to cash in these points for grocery delivery or donating their points to essential workers. As the recovery progresses, it will be interesting to see how loyalty programs continue to flex.

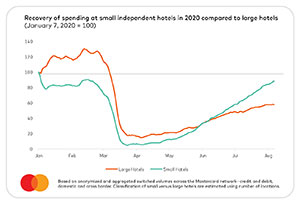

Localism Takes Off: Consumers have maintained a tighter footprint, opting for day trips, or camping within a few hours of their homes. As I mentioned, our data found Canadians to be one of the highest purchasers of gas during COVID-19 compared to the other G20 countries.

Data Drives the Customer Journey: We all know research is a key component to planning day trips and other travel, so using data and AI to customize the customer journey encourages repeat spending. For example, Mastercard recently applied data-driven insights to an airline’s promotional strategy to identify a potential 30% increase in booking on select routes.

Can Mastercard provide any data on corporate vs. leisure travel spending? If so, what are some notable trends?

Looking at why people are travelling, consumer air travel is recovering faster than corporate air travel likely as a result of risk and cost management. Thanks to all the different video conferencing technology we’ve seen surge in popularity and usage since the onset of the pandemic, this temporary solution is helping fill the gap for in-person meetings as restrictions remain in place.

On the ground, rental cars follow airlines in showing a quicker recovery of consumer over commercial spend. The reasons are similar, but the difference is less pronounced in car rentals than air travel presumably due to ease and differences in costs. Land transportation such as buses, taxis, and cruise show a slightly faster recovery in commercial. Though the recovery is slower than air travel, cars remain the preferred method of transportation across the board.

On the ground, rental cars follow airlines in showing a quicker recovery of consumer over commercial spend. The reasons are similar, but the difference is less pronounced in car rentals than air travel presumably due to ease and differences in costs. Land transportation such as buses, taxis, and cruise show a slightly faster recovery in commercial. Though the recovery is slower than air travel, cars remain the preferred method of transportation across the board.

How would you describe where the travel & tourism industry is right now? Is it in the reopening stage or is it in the recovery stage?

Based on the insights in the report, the travel and tourism industry is undergoing a serious recovery, but I believe there are enough promising upticks to remain optimistic. Right now, our focus should be on how travel behaviours are pivoting, what consumer demands are evolving and how we can support the needs of all players in travel to map out a new future for the industry.

Is there any other information Canadian Travel Press readers should know?

While there’s no escaping the impact that COVID-19 has had on the travel industry, there are some promising upticks in spending and trends that have emerged that will forever shape the travel sector going forward.

I think it’s important to note that once the effects of COVID-19 turn around and the economy begins to rebound, the story won’t be so much about how people stopped travelling but rather, it will be about how their travel behaviours changed along the way.

That’s something we should keep an eye on.

Is there reason for the travel and tourism industry to be optimistic? What’s the reason?

Absolutely.

There’s no doubt that people love to travel, and we’re seeing that in the pent-up demand. How people are travelling, though, has adapted during this time. Gas spending, restaurant spending, bike rental spending – all are improving, showing that the rebound is happening but is focused on local travel and local spending.