Conference Board of Canada

Outbound Canada summer travel outlook

In its Travel Outlook for the summer of 2020, the Conference Board of Canada reports that amidst the global COVID-19 pandemic, summer travel intentions have fallen to the lowest level ever.

What follows are excerpts from the Conference Board’s latest report:

Summer Travel Intentions

As expected, the proportion of surveyed Canadians planning to take a leisure trip this summer has plummeted to its lowest level ever recorded—a direct result of the COVID-19 pandemic and the associated physical distancing requirements and travel restrictions currently in place.

Overall, just 45% of Canadians are planning to take a leisure trip in the coming months, a massive decline compared to previous years. The proportion of respondents who are currently planning any leisure travel this summer has decreased most dramatically in Alberta (-38%), Ontario (-36%) and BC (-35%). Of those planning a trip, less than one-third intend to leave the country (31%), while 65 per cent are planning to travel domesticallyHowever, the Conference Board notes that despite this negative sentiment, there is an element of “wait and see” being reported. The share of respondents who are currently unsure about their upcoming travel plans has jumped to 22% compared to 9% one year ago. Of these potential travellers, 80% cited COVID-19 as the primary reason they are unsure about their summer travel activity.

In addition, more than half of respondents who outright said they would not be taking an overnight leisure trip pointed to the virus as the main driver of their decision.

Forty-three per cent of those who reported they were unsure or would not travel in the coming months took a leisure trip last summer.

If restrictions are eased and a conservative portion of previous travellers who are currently uncertain about their summer plans change their minds, overall travel intentions could increase to 50% to 60%.

However, any additional travel not currently being considered is likely to have a domestic destination.

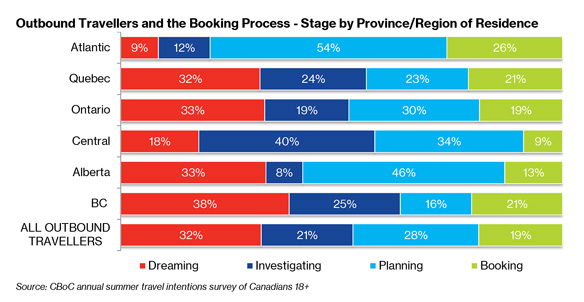

While there is an element of optimism in the reported travel intentions, a larger share of travellers than last year are still in the dreaming phase of trip planning (+9.4%) and a much smaller share has completed the booking process (-7.4%); additional indicators of the significant uncertainty in the market.

VFR Drives Planning

After enduring weeks of physical distancing measures, visiting friends and relatives (VFR) is driving a larger share of outbound travel planning than in previous years.

While vacation/pleasure trips still account for the biggest proportion of intended travel, the primary purpose of 27% of outbound trips is VFR activity (compared to 22% in 2019).

Trip timing is also being affected by the pandemic.

Last year, 17% of outbound travellers planned to take their trip in May and June. This proportion has dropped to 10% this year.

There is also a slightly bigger share of travellers who have not yet picked a date of departure and more trips than usual are being planned for the latter half of the season.

While 37% of outbound trips last year were planned for Aug, Sept, and Oct, the share has jumped to 56% for 2020.

This booking pattern is especially true for trips destined for the Asia-Pacific region (67%) and the US (58%), while about half of travel to Europe/UK (53%) and the Caribbean and Mexico (49%) is being planned for the latter half of the season.

Of course, the Conference Board points out, the likelihood of this activity occurring will depend on when countries re-open their borders and to what extent quarantine measures remain in place.

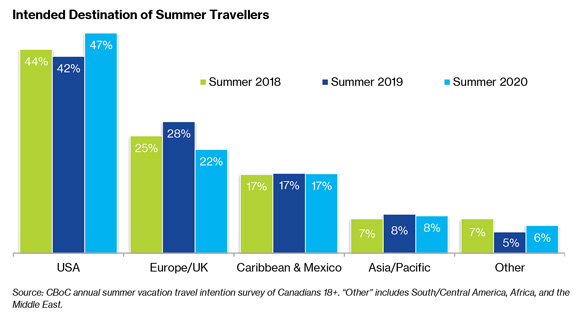

Outbound Travel Destinations

With just 14% of total respondents planning an outbound trip, intentions to travel outside of Canada are, understandably, quite poor for the upcoming season.

But within this group, the proportional distribution of trips planned for each region is mostly comparable to previous years.

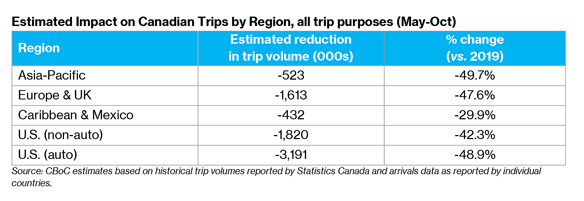

However, even though the pattern of planned activity is stable, there will be extreme declines in the actual volume of outbound trips throughout the season and beyond.

Half of outbound travellers with an intended destination are planning to vacation in the U.S., a larger share than previous seasons.

At the same time, a similar proportion intends to travel to AsiaPacific destinations and the Caribbean and Mexico, and a smaller share is planning to vacation in Europe/the UK.

Of those who still need to book their accommodation, transportation, or vacation package, 52% report that they will finalize their plans six weeks or less prior to departure.

Travellers with a long-haul destination are less likely than those with a short-haul destination to be in the late stages of their trip planning. Nearly half of trips to the US (47%) and 62% of trips to the Caribbean/Mexico are in the final planning or booking phase.

On the flip side, travellers planning to travel to the Asia-Pacific region (41%) or Europe/UK (39%) are the most likely to still be dreaming about their trip.

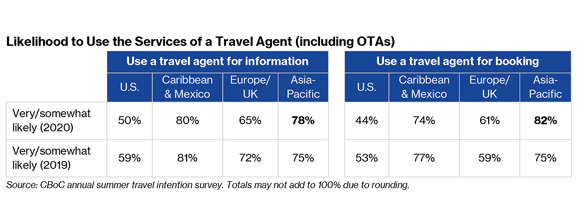

Use of Travel Agents

Sixty per cent of Canadians planning an outbound trip this summer intend to use a travel agent, including online agencies, for information (63%) or to book some aspect of their trip (59%).

Travellers heading to the US remain the least likely to use these services, while those heading to the Caribbean/Mexico or the Asia-Pacific region are much more likely to rely on an agent.

Compared to last summer, those planning to travel to an Asia-Pacific destination are reporting a slightly higher likelihood to book their trip through an agency.

This suggests a desire for the relative assurance of personal safety and trip security an agency can offer that an independently booked trip may not.

In contrast, the share of travellers planning a trip to the U.S. who intend to refer to a travel agent is even lower than usual, likely due to a higher than normal proportion of repeat travellers.

Summing up Summer 2020

Travel restrictions, quarantine measures and border closures will have a significant negative impact on travel to the US and other international destinations in the coming months.

COVID-19 Impact

Despite some initial signs of recovery, the tourism sector will be drastically changed when restrictions on movements are eased. Consumers are starting to think about travelling again but are still wary about what this activity will look like in a post-pandemic environment. Various polling suggests that activities associated with large crowds will continue to be viewed with caution until at least next year.

For now, travellers may seek to control their personal environment by making a switch from air travel to train and auto trips. And, travellers are increasingly expecting businesses to intensify their cleaning/sanitization procedures and be transparent about their efforts.

While Canadian travellers are quite resilient, the pandemic will have a major impact on discretionary spending in the short-term.

Canada’s economy is estimated to have contracted by 9% in March, which would be the largest monthly decline on record.

Consumer confidence also registered a record-breaking drop in March and followed that up by falling to its lowest-ever recorded level in April. In all, the index fell by 73 points in just two months.

During this time, more than a third of Canadians expressed concern about losing their livelihood. Additionally, the businesses servicing travellers have taken a huge hit and the longer restrictions are in place, the higher the probability of closures.

A change in tourism supply may affect how and where people travel. Airlines are trying to cope with sharp declines in activity and the struggle will be made even worse by suppressed demand for the remainder of the year.

With the grounding of almost all transborder and international flights until at least May 31, outbound service on Canadian carriers has now been reduced by almost 4.6 million direct seats throughout the second quarter, due to a 96% decline in service in both April and May.