Changes in the Montreal Convention

There have been recent changes – not major, but nevertheless worthy of note – in Montreal. That’s Montreal the Convention, not Montreal the City.

When it comes to international air transportation, Canada (like most of the world) is subject to a pair of key treaties.

The Warsaw Convention was the first attempt by the international community to reach agreement on the liabilities associated with air travel, that was (when concluded in 1929) becoming increasingly international in nature. It has been amended twice, and then largely, but not totally, replaced by Montreal.

The Montreal Convention dates from 1999, and replaced Warsaw, wherever its terms conflict with its predecessor’s provisions. In the absence of such conflict, Warsaw still applies. Like Warsaw, it deals only with international flights and, also like Warsaw, it is part of Canadian law by virtue of the Carriage By Air Act.

Typically, a carrier will file a tariff with the regulatory body in the various jurisdictions it serves internationally. In Canada, this is the Canadian Transportation Agency (CTA). In its tariff, a carrier will set out the contractual terms of its liability with respect to its transportation of passengers, and of goods. This includes damages flowing from

a) personal bodily injury or death,

b) delays,

c) lost, damaged or delayed baggage

c) occurring during the course of

c) international air transportation of

c) passengers, or cargo.

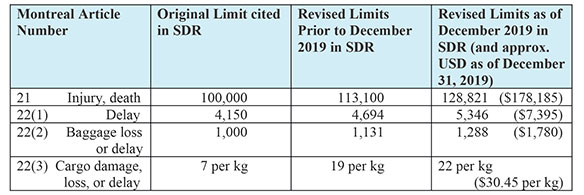

Due to these treaties, a carrier’s tariff cannot exclude liability in regard to certain specified events and amounts. Those amounts are denominated in Special Drawing Rights (SDR). Pursuant to Article 24 of Montreal, those amounts are revisited (and potentially revised) every five years, or sooner if necessary.

No change was made five years ago, so the SDR rates prevailing until December 28 of 2019 dated from the 2008 review.

The SDR is an artificial currency established by the International Monetary Fund. It establishes the value of the SDR on the basis of a weighted average of five national currencies that are seen to be representative of the world’s economy. They are the (US) Dollar, the Euro, the (British) Pound, the (Japanese) Yen, and – as of October of 2016 – the (Chinese) Renminbi.

This chart summarizes the recent changes, with the new limits being converted in the final column to USD, using the conversion rate in effect on the last day of 2019.

The 13.9% rate of increase is intended to reflect the impact of inflation since the rates were most recently set.

These recent increases will impact

iii) insurers, who will be faced with higher payment ceilings, and

iii) international carriers, who will have to pay the resultant increases in the insurers’ premiums, and

iii) passengers and cargo shippers, who will be asked to bear the carriers’ burden of increased premiums, as they are factored into air fares and cargo rates.

Unchanged, an international carrier will not be liable for damages exceeding these new limits, if it can prove that

such additional damages:

a) were not attributable to the negligence or other wrongful

c) act or omission of it, or of those for whom it is in law

c) responsible, or

b) were due solely to the negligence or other wrongful act or

c) omission of a third party.

Also unchanged, Montreal does not provide for punitive damages, or any other type of non-compensatory recovery.

Plus ça change, plus c’est la même chose.

Heifetz, Crozier, Law is a Toronto law firm that has for years represented all aspects of the Canadian travel industry. The lawyers at HCL also maintain a non-travel practice, covering litigation, real estate, Wills, corporate/commercial matters, etc. To contact HCL, e-mail i[email protected].